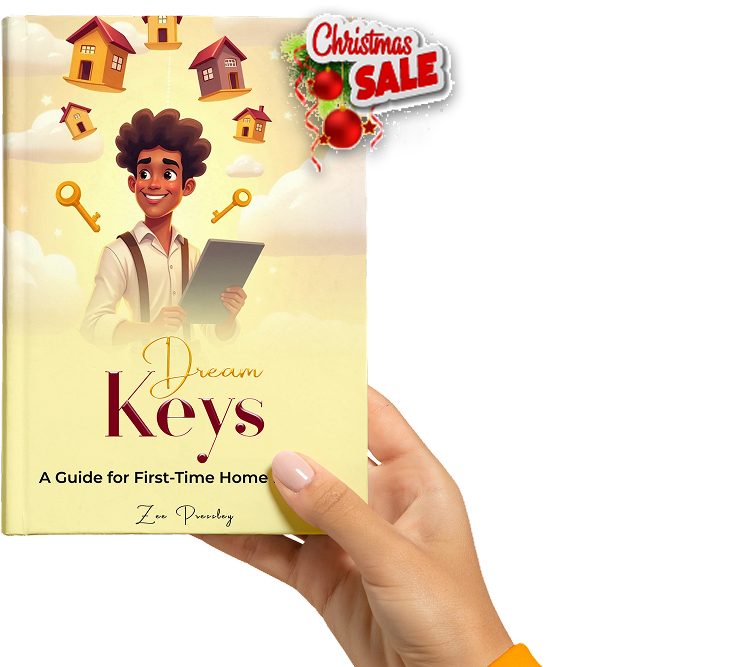

50% OFF

Unlock The

Power To Own

Empowering first-time buyers with clarity, confidence, and the keys to their dream home.

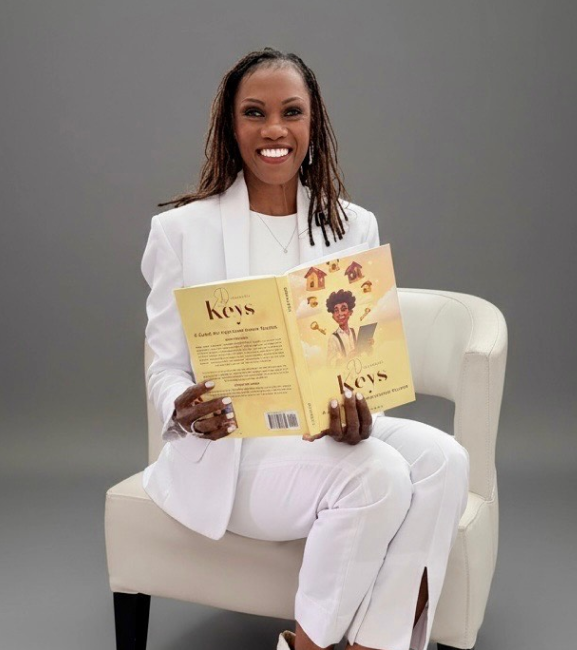

About the

Author

Zenobia Pressley is a real estate coach and the author of Dream Keys, a guidebook for first-time homebuyers ready to break through fear and ready to conquer confidence, claiming their piece of the American dream.

Zee Pressley

Entrepreneur, Writer and Coach

Dream

Keys

Your First Home Doesn’t Have to Be Complicated

Dream Keys is your step-by-step guide to homeownership, written for real people with real questions—and not-so-perfect credit.

- Budgeting & mindset help

- What lenders really look for

- Common myths that keep renters stuck

- Encouragement when things feel hard

Reviews That Speak

Volumes

We take pride in delivering exceptional service, and our clients’ feedback says it all. Their experiences reflect our commitment to quality, trust, and lasting relationships. Here’s what they have to say about working with us.

Sign Up For Free Newsletter

Free Home Readiness

Checklist

Success Stories Of Our

Trusted Partners

Discover the success stories of our trusted partners who have grown their businesses, expanded their reach, and achieved their goals with our support. Their journeys showcase the real impact of strong partnerships and shared commitment to excellence.

James

As a first-time homebuyer, I was nervous about the process and unsure of what to expect. Working with Zee Pressley made everything so much easier than I ever imagined. From start to finish, she was knowledgeable, patient, and incredibly supportive.

Elizabeth

Zee took the time to explain each step, answered all my questions clearly, and always made me feel confident in my decisions. Her professionalism and attention to detail made the entire process smooth and stress-free. I never felt rushed or overwhelmed — she truly had my best interest at heart.

Jack Connor

We had an incredible experience working with Zee Pressley! From our very first conversation, Zee truly listened to what our family was looking for in a new home, and unbelievably, we found the perfect house on the very first try!

Mason Robert

Her professionalism, attention to detail, and warm, supportive nature made the entire process smooth and stress-free. Zee guided us with care, answered every question with honesty, and made us feel confident every step of the way.

Kayla

Thanks to her guidance, I found the perfect home and had a seamless closing experience. I couldn’t have asked for a better realtor. If you’re looking for someone who is honest, dependable, and genuinely cares, I highly recommend Zee Pressley!

Thomas Joe

We are so grateful to Zee for helping us find a home that fits our family perfectly. If you’re looking for someone who truly cares and delivers results, we can’t recommend Zee enough!

Daniel William

Working with Zee Pressley was better than expected. I went from not knowing if I could get a house to being in my home in less than days.

Tre W

I went back to her for my second property and I recommend her any chance I get. I love her and you will too! .

Charlie Kyle

Working with Zee Pressley was an absolute dream from start to finish. From our very first conversation, it was clear that she was not only knowledgeable and professional but also genuinely committed to helping me find the perfect home.She took the time to understand my needs, preferences, and budget—and went above and beyond to make the process smooth and stress-free. Whether it was scheduling last-minute showings, answering questions late at night, or negotiating fiercely on my behalf, Ms. Zee always had my best interests at heart.

Alexander Joseph

What truly sets her apart is the level of care and personal attention. I never felt like “just another client”—I felt like a priority. I’m now settled into my dream home, and I owe it all to her dedication, expertise, and heart.

Emily Thomas

From the moment we started working with Zee, we knew we were in great hands. She sold my in-laws home in less than two weeks an incredible feat on its own and then dedicated herself to helping us find a new home that met not just our needs but our deepest desires. She toured countless homes with us, never rushing the process, and always remained patient and supportive.

M. Bennett

If you’re looking for a realtor who is trustworthy, responsive, and truly exceptional at what they do, look no further than Zee Pressley. You won’t regret it!

Isabella

Every question my husband and I had no matter how big or small she answered thoroughly and went above and beyond to ensure we felt confident every step of the way. Her knowledge, work ethic, and heart are unmatched.

Marshall Family

We didn’t just find a realtor we gained a forever friend who we now consider family. Working with her has been one of the best decisions we’ve made. Thanks, Zee!

Our Recent

blogs

Stay updated with the latest insights, tips, and trends from our blog. From expert advice to industry news, our recent posts are designed to inform, inspire, and help you grow. Check out what’s new!

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by […]

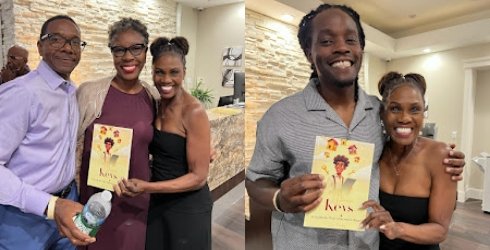

Some Moments With Our

Clients

We cherish every opportunity to connect and collaborate with our clients. These special moments capture the trust, teamwork, and lasting relationships we’ve built together. Here’s a glimpse into some of those memorable experiences.

Frequently Asked

Questions

Do I have to have good credit to buy a home?

Good credit is relevant. You can purchase a home using an FHA loan with a score as low as 580; however, rates can vary based on your score.

Are there any downpayment assistance programs?

Yes. Discuss down payment assistance options with your lender. Generally, these programs are area-specific.

Can I purchase a home with no money down?

Yes. If you are a VA and/or buying a USDA home. No down payment is required. However, your lender can guide you to additional programs that may be available in your area.

How much money do I need to buy a house?

You will need to plan to pay your down payment, typically 3-3.5% of the home cost, and any associated closing costs. However, closing costs can be negotiated in most instances.

What if I want to buy a condominium or townhome?

Condos and town homes come with conveniences; however, these conveniences are paid for by the buyer. There is usually a monthly maintenance fee that is calculated in the total monthly cost of the residence.

Can I buy a home and flip it?

Yes. However, do your homework. Ensure that the investment is worth the risk. Consider who will do the renovations, if needed, and the cost of renovations.

How long do I need to work to buy a home?

Two years is standard; however, there are other conditions, such as having a certificate of completion or a degree in the field you are working in. Speak with your lender regarding the specifics of your situation.

Do I have to be married to my partner to buy a house together?

No. As long as both partners are of legal age or representation, you can purchase a home together.

Should I wait for interest rates to go down to buy a home?

No. If you are in a position to purchase a home and the house is right for you, buy it. You can buy down the rate, or refinance later when the rates are lower.